When shopping and comparing Medicare Supplement (Medigap) plans there are many things to understand before making a decision on which insurance company and plan to purchase.1

Some of the things you should understand before you purchase are:

- You must have Medicare Part A and Part B first before getting enrolled in a Medicare Supplement Insurance Plan. You should contact the Social Security Office to inquire about enrolling in both Part A and Part B several months in advance of your 65th Birthday (or several months before you become eligible Medicare Part B, for example if you plan on working past your 65th Birthday, etc.)

- You should understand that the Plan Letters for Medicare Supplement Plans are “standardized" by the Federal Government. Which means if you are shopping, for example for a Medicare Supplement "Plan F,” then all the Medicare Supplement Insurance companies are required to offer the same exact Standardized “Plan F” plans, however they are allowed to charge different premiums. So basically you want to shop for the lowest premium of the specific plan you choose, since the only real difference will be the premium prices of the same exact plan from one Medicare Supplement insurance Company to another, with the following exceptions:

- You should make sure the Insurance company is reputable and pays their claims on time. (Otherwise just a low premium price doesn’t really matter, if the Medicare Supplement insurance company isn't paying your claims on time.) It is also a good idea to check the insurance company’s financial rating, since you want to make sure they will be around in the future for paying your claims.

- You should check on the previous history of annual rate increases. Although the previous history doesn’t guarantee future rate increase percentages, it may give you a better idea of their track record from the past. Some Medicare Supplement plans can increase quite a bit more annually than the same exact plan from another insurance company. Keep in mind that if your premiums go up, you don’t automatically qualify for another Medicare supplement with a different insurance company in your later years, since there are underwriting questions asked, which depending on your health you may or may not qualify to be approved. So you may be stuck with your original Medicare Supplement's higher premium rates or be forced to choose to switch to a different type plan. (Such as: Medicare Advantage or keep plain Original Medicare without a Medicare supplement.)

- Some Insurance companies may offer additional (value-added) services on top of the basic benefits. (Value-added services vary by state and generally can be discontinued at any time!)

- Many Insurance companies may have different underwriting criteria. Meaning if you do not qualify for either "Open Enrollment” or “Guaranteed Issue,” you could possibly get declined with one insurance company but still get approved with another insurance company since each insurance company may have specific underwriting guidelines you need to fit into in order to be approved.

- One insurance company allows you to switch plan letters anytime during the year within the same company. You can call and just request to be switched to a different plan letter and it will be effective the 1st of the next month! Check to if the insurance company you choose offers this benefit. Since that could turn out to be a real advantage if find you are ill mid-year with lots of out of pocket expenses.

- You are not allowed to have both a Medicare Advantage Plan and a Medicare Supplement plan at the same time!

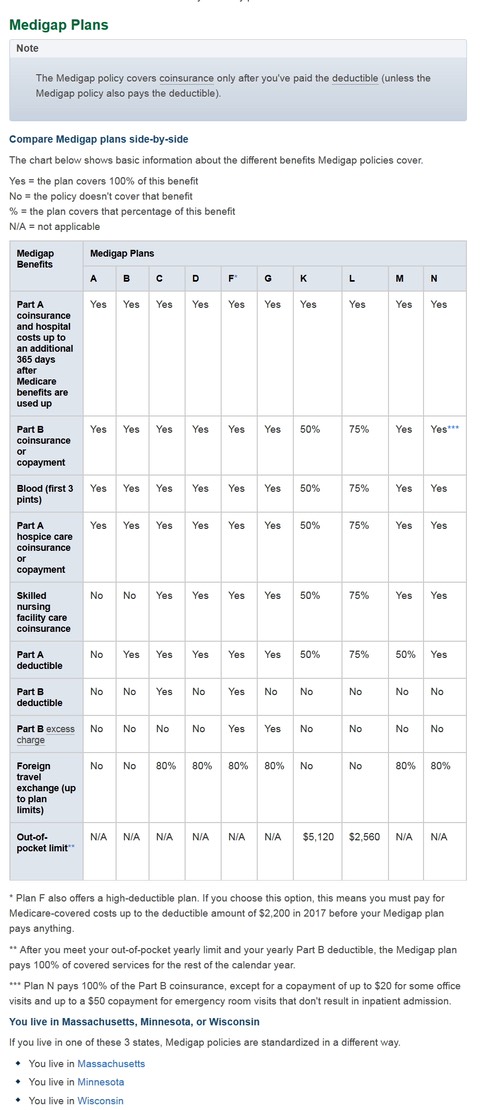

- There are many Medicare Supplement plan letters to choose from. See chart below. Make sure you understand the benefits and the monthly premium amount of the specific plan letter you choose before enrolling.

- The private insurance company's Medicare Supplement premium is in addition to your monthly Part B premium you pay to Medicare. (and also in addition any premium you may pay for Part A as well, if applicable. Most people don’t pay a premium for Part A. However there are some that do.)

- Any standardized Medicare Supplement plan is guaranteed renewable even if you have health problems as long as you stay with the same company continuously. The means the insurance company can not cancel your Medicare Supplement as long as you pay your premiums.

- Newer Medicare Supplements (Sold after Jan. 1, 2006) aren’t allowed to cover prescription drug coverage. However you can enroll in an additional Prescription Drug Plan (Part D plan) if you want prescription drug coverage.

If I can assist you with your Medicare Supplement enrollment questions, please call me at

941-404-5334 to make an appointment. I will come to you! (if relatively local.)

1. Note: The information below applies to Florida. (Some other states may have similar information or different regulations. However since I am licensed in the state of Florida, my information pertains to Florida. You will need to check your own states' regulations if you permanently reside in another state, since other states may have different regulations. For example: In Massachusetts, Minnesota and Wisconsin, the Medicare Supplement policies are standardized in a different way.)

Note: Medicare Insurance information can be overwhelming and confusing to many people. As an independent licensed agent I can explain things to you in simple terms so you feel comfortable making a decision. Then I can help you choose and enroll in a plan that you feel fits your needs.

By the way, it doesn’t cost you any more if you enroll in a Medicare Insurance plan through me as an independent agent versus directly with an insurance company either over the phone or via the Internet, since I get paid by the insurance companies for your enrollment. Plus you will have personalized service by a local agent. If you would like my assistance, please call me at 941-404-5334.

By calling this number, I understand I will be directed to a licensed insurance sales agent.

_____________________________________________

See chart below of different Medicare Supplement (Medigap) plans side by side:1

Note: Not all Medicare Supplement (Medigap) plans are offered in every state by every Medicare Insurance Company.

1. Source: Medicare.gov as of 4-26-17