Depending on certain factors, many people that bought their Medicare Supplements years ago are grandfathered into their Medicare Supplement plan premiums at “issue age.” (Meaning the age when you got approved on your current Medicare Supplement Plan.) In those cases, the only annual increases you may have had, should have been just inflationary increases across the board. Those type of annual increase were not age related, nor related to health issues that occurred after the start of your plan. However, if you switch to a different insurance company or later come back to the same company after leaving, your premium will now be priced at your current age. Therefore you most likely already have the lowest premiums. Although in certain situations, it is still possible to try to lower your premiums. So if you would like me to shop your current Medicare Supplement premium to compare with another insurance company to determine if you can possibly get a lower premium with the same coverage, please call me with the following information:

- Your current monthly premium of just your Medicare Supplement (NOT including your Prescription Drug Plan premium)

- Your zip code

- Your birth date including year

- The Plan Letter of your current Medicare Supplement Plan (Example: Plan F)

- Whether or not you are a tobacco user.

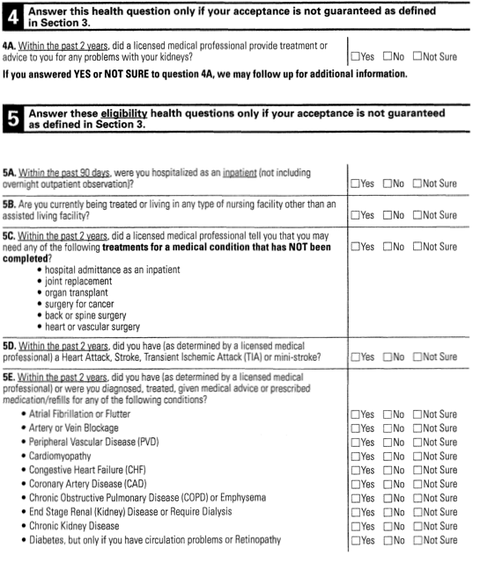

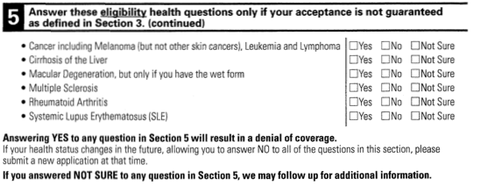

Note: Before shopping rates, keep in mind when switching Medicare Supplement plans after 65 (unless you qualify for guaranteed issue for another reason), now going forward you will need to be able to pass underwriting to be approved for a new policy. There are a series of questions the insurance companies ask on the application. Unfortunately if you answer “yes” to any of those questions, you will be declined. I am pasting below a sample of the questions from one insurance company to help determine if you would be able to be approved before comparing prices. Most underwriting questions from Medicare Supplement Insurance companies are similar, but each company may ask different or additional questions. Attached is just a sample of the underwriting questions from one company.

If you have questions, please feel free to call me.

To Read More Click On Related Blog Post Link Below:

Medicare Supplement Shopping & Comparison

Note: Medicare Insurance information can be overwhelming and confusing to many people. As an independent licensed agent I can explain things to you in simple terms so you feel comfortable making a decision. Then I can help you choose and enroll in a plan that you feel fits your needs.

By the way, it doesn’t cost you any more if you enroll in a Medicare Insurance plan through me as an independent agent versus directly with an insurance company either over the phone or via the Internet, since I get paid by the insurance companies for your enrollment. Plus you will have personalized service by a local agent. If you would like my assistance, please call me at 941-404-5334.

By calling this number, I understand I will be directed to a licensed insurance sales agent.